Tax season can be stressful for everyone, but for individuals with Individual Taxpayer Identification Numbers (ITINs), an expired number can add an extra layer of worry. Here at Paisano Tax, we understand the importance of keeping your ITIN up-to-date. This blog will explain what to do if your ITIN has expired and how Paisano Tax, a Certified Acceptance Agent, can assist you with the renewal process.

Why Do ITINs Expire?

ITINs are not permanent and typically expire after three years of non-use for tax filing purposes. This means if you haven’t filed a U.S. tax return in the past three years, your ITIN may no longer be valid.

What to Do if Your ITIN Has Expired?

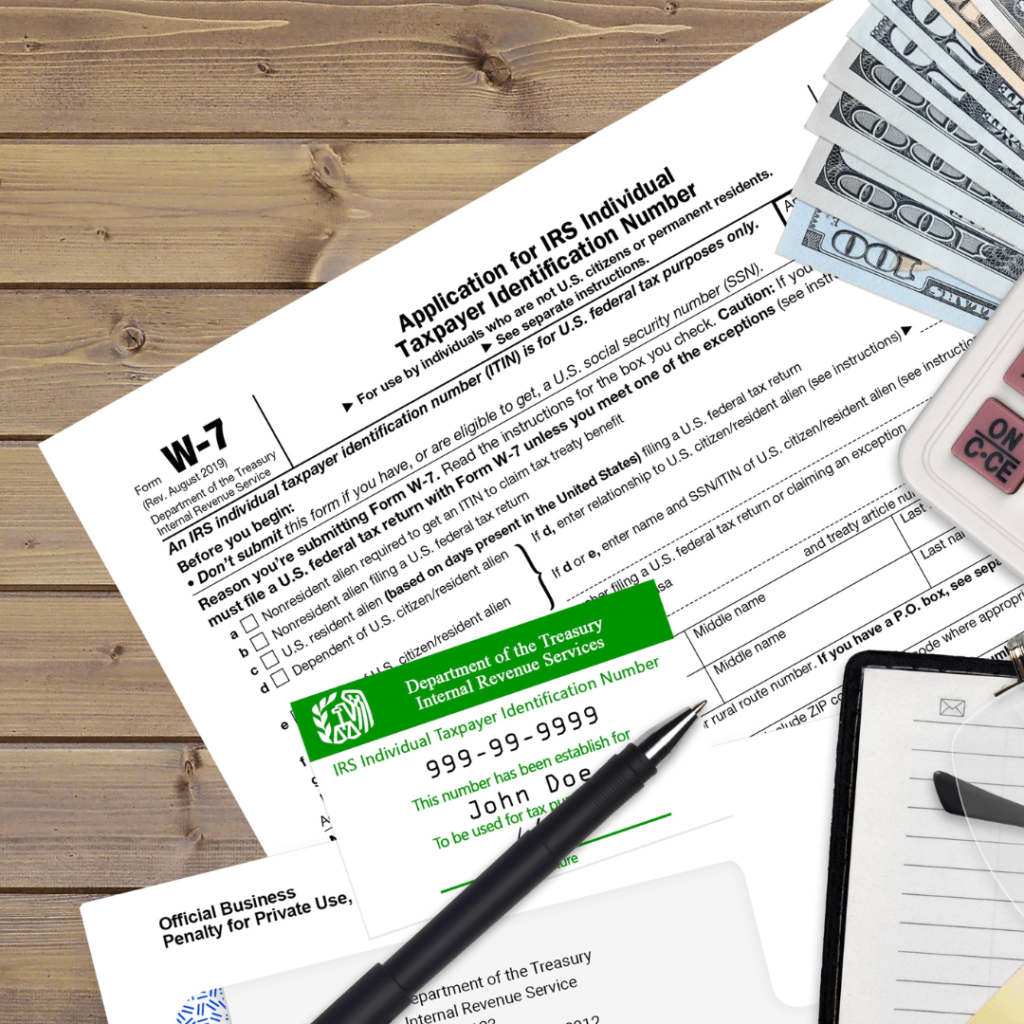

The good news is that an expired ITIN can be renewed! The process involves submitting a completed Form W-7, Application for IRS Individual Taxpayer Identification Number, along with the required identification documents, to the IRS.

Why Choose Paisano Tax as Your ITIN Renewal Partner?

Paisano Tax is a Certified Acceptance Agent authorized by the IRS to assist with ITIN applications and renewals. This means we have the knowledge and expertise to guide you through the entire process. Here’s how Paisano Tax can help:

Don’t Wait Until It’s Too Late!

Addressing an expired ITIN proactively ensures you can continue to file your U.S. tax returns without any complications. At Paisano Tax, we’re here to help you navigate the ITIN renewal process with confidence.

Contact Paisano Tax today! We’ll answer your questions and guide you through the steps to get your ITIN renewed quickly and efficiently.